Kenya on the Brink?

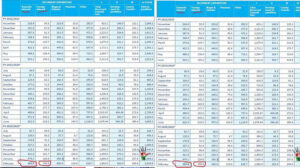

Kenya’s public finances are showing worrying signs of strain, with newly released government data revealing that a staggering KSh 722 billion was spent on debt interest in just the first eight months of the current financial year. This amount represents a critical inflection point in the country’s fiscal management and raises serious concerns about long-term sustainability.

According to the Treasury’s disclosures, domestic debt obligations consumed KSh 565.8 billion, while external debt interest stood at KSh 156.5 billion. When placed alongside the tax revenues collected over the same period—KSh 1.4 trillion—the picture becomes even more alarming: interest payments alone accounted for 51% of all tax income.

To put this in perspective, Kenya is currently spending an average of KSh 90 billion per month solely on servicing debt interest, not principal repayments. If the trend continues through to the end of the fiscal year, total interest payments are projected to surpass the KSh 1 trillion mark for the first time in the country’s history.

These numbers are not just abstract statistics—they are a clear indicator that Kenya is sliding into a debt distress zone. Spending more than half of all tax revenue on interest alone leaves little fiscal space for critical sectors such as healthcare, education, infrastructure, and social safety nets. It also erodes investor confidence and risks pushing the country into a sovereign debt crisis.

So, what does this mean for the average Kenyan?

It means fewer services, higher taxes, and more borrowing—creating a vicious cycle that is hard to escape. The government’s increased reliance on domestic borrowing also crowds out the private sector, making it harder for businesses to access affordable credit and slowing economic growth.

Perhaps more troubling than the figures themselves is the lack of political will to address the crisis. Parliament, which is constitutionally mandated to exercise oversight over public finance, has largely failed to check the government’s borrowing appetite. Kenya currently operates without a binding legal framework that caps debt based on revenue capacity.

It’s time to ask difficult but necessary questions:

- Why hasn’t the debt ceiling been tied to the country’s actual revenue base?

- Why is there so little transparency and accountability in debt contracting?

- And most urgently: How can a country survive when more than half of its tax income goes toward interest payments?

Kenya urgently needs constitutional and legislative reforms to anchor debt ceilings on revenue performance rather than arbitrary numbers. Doing so would not only provide a fiscal safety net but also restore public trust and investor confidence.

Reform proposals must include:

- A debt cap tied to a fixed percentage of tax revenue

- Mandatory public disclosure of all loan terms

- Parliamentary approval for all new significant borrowing

- An independent debt audit commission

These changes would help safeguard Kenya’s economic future, ensuring that borrowing is aligned with long-term development goals and national capacity.

Kenya is not bankrupt yet—but it is teetering dangerously close to the edge. The current debt trajectory is unsustainable, and the cost of inaction could be severe. The writing is on the wall, and the numbers speak for themselves.

Fiscal responsibility is no longer a choice. It is a necessity.